Purchasing a home is an exciting and memorable event, but there are hidden homeownership costs that many first-time buyers fail to consider. Ongoing home maintenance will cost you thousands each year, and 45% of homeowners underestimate the cost of home maintenance. Underestimating home maintenance costs leads to debt, stress, and financial and relationship strain. Your home should be a place of comfort and stability! Budgeting for home maintenance is not difficult. Follow the tips in this article, and you will be financially prepared for regular maintenance and major repairs.

1. Account for the home’s materials, effective age, condition, and size

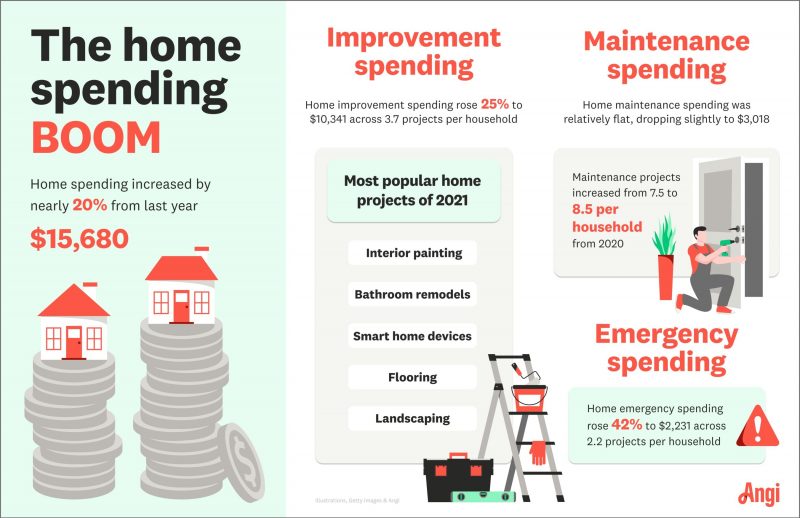

Experts say to budget 1-4% of your home’s value annually for maintenance. This varies depending on the building materials used, age, and condition of your home. 1% will likely be OK for homes built within the last 5-10 years. All the home’s systems are new, but you will have expenses outfitting your home with shelving, blinds, landscaping, and more.

Age

Older homes will likely have more frequent and expensive needs, so if your home is more than 30 years old, budgeting in the high-end range is a good idea. If your home is neither brand new nor significantly old, you’ll likely fall in the 2-3% budget range. Consider the age of the systems in your home and calculate when large repairs will likely be needed to narrow this down.

The least expensive home maintenance will come from a home about 2-5 years old – the current owners have likely outfitted the house, and the technology and appliances still have a long lifespan. If you’re unsure whether an old or new home is right for you, check out our article about building a new home.

Effective Age

A 100-year-old home with excellent maintenance may be less costly to maintain and update than a poorly maintained 30-year-old home. Carefully consider the effective age of all the systems in the home. You will subconsciously do this on your first walk-through and then thoroughly evaluate during the home inspection process. Generally, a home older than 15 years will require additional savings for upcoming large ticket purchases such as appliances, fixtures, and updates.

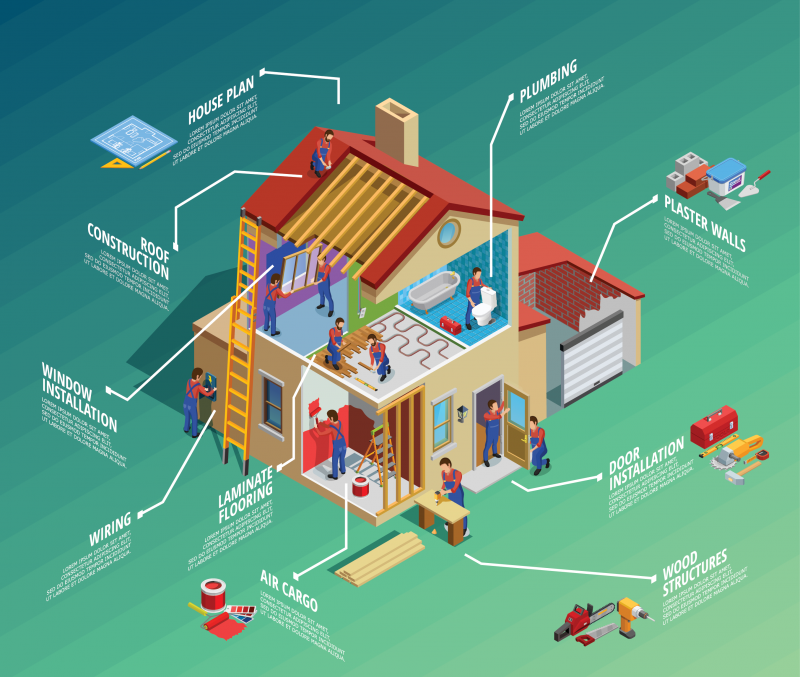

Materials

A home with a painted wood exterior may exude character, however, be aware that it will need to be painted regularly, which takes time and money. Your home inspector can tip you off on the quality and maintenance characteristics of the materials in your home.

Size

More space means more maintenance. With a bigger home, a roof replacement requires more materials, there are more windows to clean, and the HVAC installation will cost more. When preparing your budget, you can estimate your annual maintenance costs by calculating $1 per square foot. This method is suitable but isn’t as accurate as using the value adjusted to your home’s location and condition. When shopping for homes, remember that operating and maintenance costs go up with more extensive square footage.

When advising on how to budget for maintenance and repairs, real estate investor J. Scott assures that these costs are to be expected: “Any homeowner’s going to have to deal with [capital fixes], whether it’s now or 20 years down the road…the key isn’t necessarily to avoid those costs, and the key isn’t to save up all the money quickly. The key is to anticipate it and have a plan”.

2. Keep up with regular maintenance

Save money down the line by prioritizing regular maintenance throughout the year. Spending 15 minutes cleaning your dishwasher filter can increase its lifespan and help you defer substantial replacement costs. Being vigilant about keeping water out of and away from your house can save thousands in the long run. The Cash Value of Home Maintenance states that $1 spent on maintenance will save you $100 in repairs. Not sure where to start? Our Spring Home Maintenance Checklist will guide you through the process. It’s better to spend a little bit of money now than a lot later.

3. Contribute to your savings

Start a home maintenance savings account and contribute to it! Some months will cost you more than others. If you end up under budget, avoid the headache of being unprepared by keeping unspent funds in a savings account for inevitable big fixes down the road. Large-scale fixes like a roof or furnace replacement will cost thousands. If your central air conditioning breaks down during summer heat, you’ll be glad you have enough saved to get it fixed ASAP! HomeLight’s Major Home Repair Costs give you a more specific idea of what to expect for various fixes.

4. Get a Home Inspection

When a home is listed for sale and staged, it’s easy to focus on the cosmetics and aesthetics. However, some of the most expensive repairs aren’t visible to the average eye. The home inspection helps identify and negotiate repairs on large-ticket items needing attention. Just as important, a good home inspection becomes your guidebook for future maintenance and repairs. It will identify the effective age of all the systems in your home and when you should expect a large repair bill to hit. For instance, a furnace and air conditioner system typically lasts 20 years, so if the system in the home you are considering is 15 years old, you will need $10,000 (in today’s dollars) for this significant repair five years from now.

A professional home inspector is also an excellent resource for a new homeowner after the sale. The ones we use are available to answer questions about maintenance and repairs and help locate better contractors.

5. Prepare for the weather

Preventative maintenance year-round will allow you to enjoy Michigan’s freezing winters without stress and worry. Freezing and thawing weather can cause severe damage to your home, such as roof leaks, burst pipes, deteriorated concrete, and foundation issues. Follow our fall and winter home maintenance guidelines to prepare your Ann Arbor area home for winter hazards and damages.

6. Budget for landscaping

Most buyers look for a home with a beautiful backyard to host bonfires and plant a garden in, but this is another monthly cost to consider. Depending on the size and scope of your yard, day-to-day lawn maintenance may cost from $1200 to $3600. You can save if you are a do-it-yourselfer, but remember buying, maintaining, and storing yard equipment costs money too. If you are considering a home with a fixer-upper yard, this article by Homes and Gardens advises on budgeting a capital-fix landscaping project. When shopping for homes, watch out for large trees that need maintenance or removal. The cost to remove a large tree can get into the $3,000 range. Also, look out for terraces that will eventually need repair or replacement.

Well-Maintained Homes Sell for More Money

When it’s time to sell your Ann Arbor home, you will reap the rewards of a solid maintenance program in the form of a higher sale price. Yes, you will get some of it back! Home maintenance affects how others see the home. Your home will show better than others on the market. It will have more curb appeal. It will have something special that the other homes don’t have: years of reasonable maintenance and care compound over time. You will have a smoother sale, too, with fewer or no inspection problems or buyers backing out.

Set a maintenance and repair budget, set aside savings, enjoy the independence of home ownership, and know that you are prepared for success! We are here to answer questions; please reach out to us.