Cozy in-town homes in Ann Arbor are hard to find. Limited inventory and high demand are driving up prices and competition for homes.

Real Estate Market Update for Ann Arbor Michigan, March 2022

We looked at numbers for the Ann Arbor area real estate market (all the Ann Arbor, Ypsilanti, Lincoln, Dexter, and Saline MLS areas) and compared month over month, (feb 2022 vs Feb 2021) as well as national trends. Based on this analysis, the trends we’re seeing are:

- Inventory continues to fall and is currently running at about a 1-month supply, with similar conditions expected to continue.

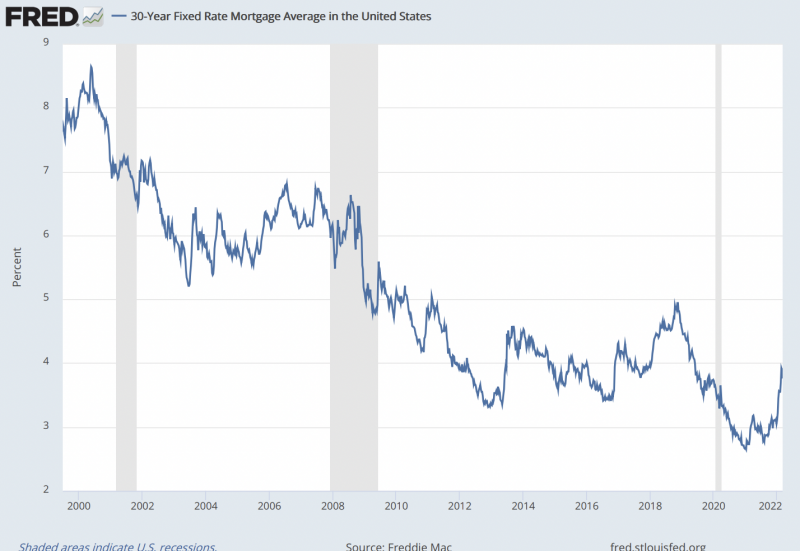

- Interest rates are rising from historic lows. They’re currently in the 4 percent range – which is still historically low, but is expected to continue to rise.

- New construction is picking up, but still way behind what is needed due to an extended period of new home construction pace that is below demand. However we expect new construction home availability to continue to rise as projects in the planning stage begin to hit the market, and as supply and shortages ease.

- Home Price Appreciation is rising sharply. Prices for the Ann Arbor market rose about 12 percent in 2021 vs 2020 – and are continuing to rise. We expect prices to continue to rise but at moderated rates.

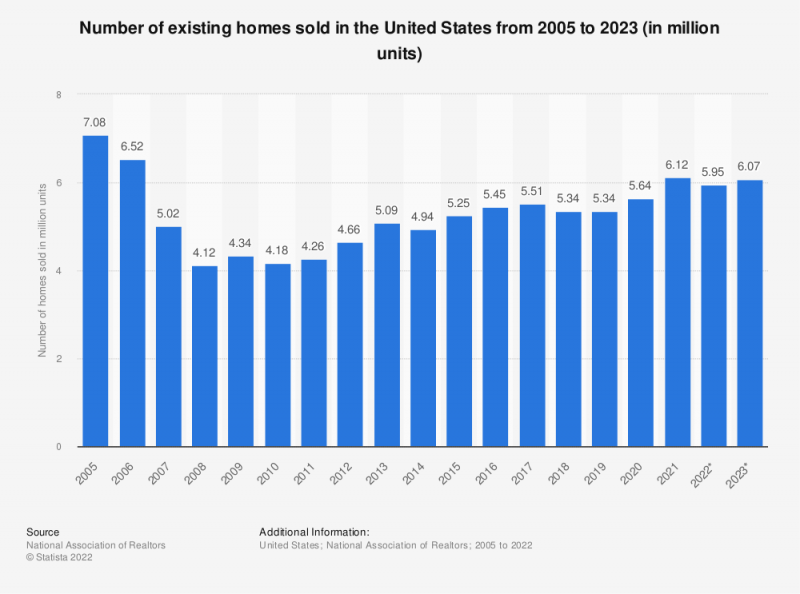

- Total home sales are projected to be near 6 million units this year, which would be a very robust sales year. Homes are coming on the market and getting sold very quickly even at these rising prices.

Inventory

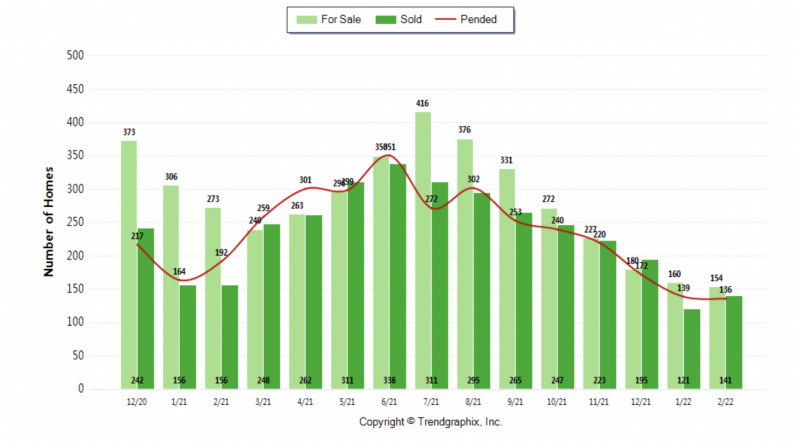

Inventory continues to fall. As of the end of February 2022, there are 154 homes available for sale in the Ann Arbor area market, compared to 273 for the same period last year – a 43.6% decline (that’s for the Ann Arbor, Ypsilanti, Lincoln, Dexter, and Saline MLS areas, comparing month over month, Feb 22 vs Feb 21). Homes going under contract were nearly equal to the new homes coming onto the market – this means that we sell everything on the market in roughly one month – or a one-month supply of houses!

People continue to move for all the usual reasons; new household formation, relocation and job change, remote work trends, and downsizing, and this is fueling buyer demand. Meanwhile, sellers are not seeing a cost-effective way to make a move due to high new construction costs, lack of units available, and Michigan’s pop-up tax (which for long-term homeowners means their taxes may be higher even in a much smaller new home). For these reasons, we will continue to see low inventory and a strong seller’s market into the future.

Homes sell one at a time, so those who are really determined to make a move are successfully finding homes that meet their needs at prices that work for them, even in this environment of continually rising prices.

It’s worth noting that we had the most inventory last year relative to the number of homes sold during the periods from January-February and July-September. In my experience, these are great times for buyers to shop for homes.

Mortgage interest rates could easily make their way up to 5 percent and still, be relatively low in historic terms.

Interest Rates

Buyers generally buy based on a monthly mortgage payment rather than the total price. Based on low interest rates, with rates in the 3-4 percent range, a $300,000 home with a $270,000 mortgage at 3 percent vs 4 percent makes about a $150 difference in the monthly mortgage payment. At some point, rising interest rates will price people out of the market. Low interest rates, even sub 3 percent have fueled home sales over the last few years but now the trend is heading back to higher, more historically normal levels.

When interest rates begin to rise, buyers get motivated to “get things done” out of fear of missing out (FOMO) on low rates! We are presently seeing a high sense of urgency in buyers to find a home and lock in low interest rates and payments for the long term. As rates rise further we could see demand erode as buyers get priced out of the market thus reducing demand.

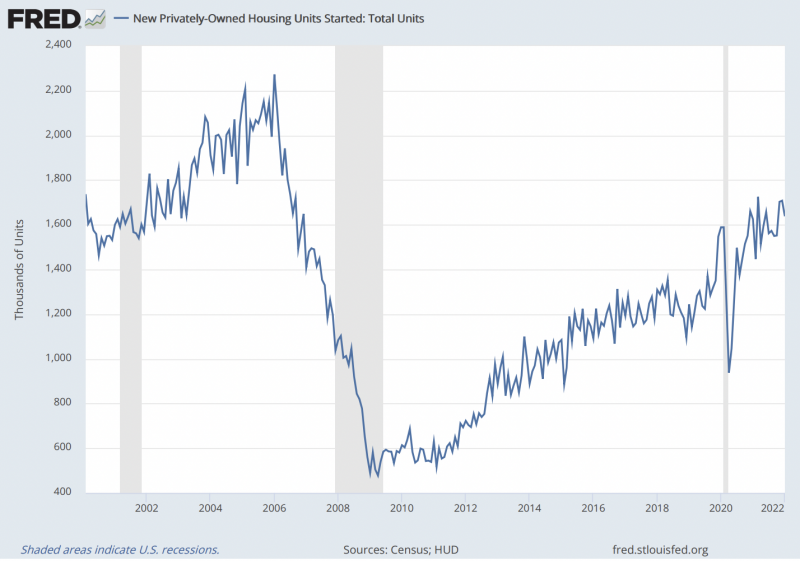

New Construction

The United States is in the midst of a severe housing shortage (crisis levels) as a result of a persistent underproduction of housing during the last decade. While the total stock of U.S. housing grew at an average annual rate of 1.7% from 1968 through 2000, since then the U.S. housing stock has only grown by an average annual rate of 1%, and only 0.7% if we look at just the last decade – in other words, less than half of the longer-term historical growth. The underbuilding gap in the U.S. totaled more than 5.5 million housing units in the last 20 years.

Until we have the housing stock available, we will continue to be woefully short on homes for buyers. It could be years before new construction catches up, however, we are now headed in the right direction.

Here is a recap of why we are in such a low housing inventory position:

High rate of household formation: It’s a known fact that the millennial generation is the largest, and this is a group that is in its prime household-formation years (household meaning a nuclear family, couple, or group of people living together). As a result, 12.3 million new households have been formed since 2012, while just 7 million new homes were built during that time. And due to soaring home prices in the U.S. over the past year or so, the inventory issue is even worse at the lower price points that buyers from newly formed households tend to gravitate toward. Many U.S. markets, including Ann Arbor, for example, have less than one month of inventory on the market, while six months would be considered a balanced market.

Supply chain disruptions: Did you go to Home Depot when wood prices were spiraling out of control earlier this year? And have you been to any new car lots recently? If so, you’ve seen the supply chain disruptions in the economy firsthand. This has hit the homebuilding industry hard, as essential items ranging from lumber to paint are exceedingly expensive and hard to come by in large quantities.

Labor shortages: There were 10 million job openings in the United States in August – 1.4 million more than the pool of workers who could take those jobs. This labor shortage hasn’t spared the homebuilding industry, and a shortage of available workers is yet another challenge that has caused many homebuilders to be unable to meet demand.

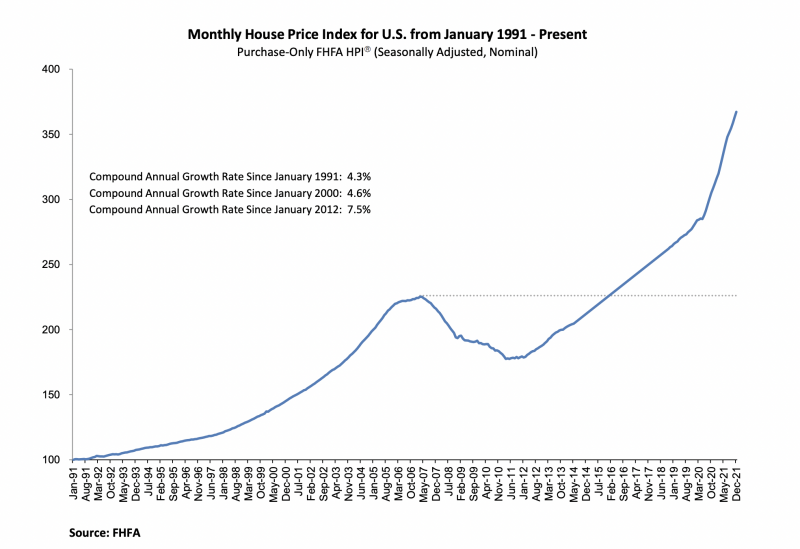

Home Price Appreciation

The annual compound growth rate since January 1991 is 4.3 percent. It took the market from 2007 until 2016 to recover from the great recession and it has been on the rise ever since. It’s likely that now the average growth rate will work its way back towards the average growth rate over the long term, as new construction catches up or a significant fall in demand takes place.

Homes are selling at the annual rate of around 6 million homes per year – the highest rate since 2006.

Total home sales in units

Homes are selling at the annual rate of around 6 million homes per year – the highest rate since 2006. So if people tell you that it is impossible to purchase a home, there are 6 million people that can tell you otherwise. While inventory is constrained, people in Ann Arbor , MI who are intent on buying a home, can and are doing so. Competition for homes has increased and it will continue to remain very competitive. Buyers need to be prepared to act quickly, often with only one or two days in which to prepare their acquisition plan and submit offers.

Expect multiple offers, offers with aggressive terms such as limited or no inspections, cash, and high down payment, signing bonuses, and appraisal shortfall waivers to be the norm in 2022 – especially for homes in excellent condition in top locations.

If you would like to have a confidential conversation about buying or selling a home in today’s market, please reach out to us.

Sources:

https://fred.stlouisfed.org/series/MORTGAGE30US

https://www.cnbc.com/2021/10/05/even-with-low-interest-rates-mortgages-are-becoming-unaffordable.html

https://www.usatoday.com/story/money/personalfinance/real-estate/2021/09/24/5-million-more-homes-needed-in-the-us-what-investors-need-to-know/118840812/

https://www.forbes.com/sites/graisondangor/2021/06/16/the-housing-shortage-is-worse-than-ever-and-will-take-a-decade-of-record-construction-to-fix-new-reports-say/?sh=7b7427144953

https://cdn.nar.realtor/sites/default/files/documents/Housing-is-Critical-Infrastructure-Social-and-Economic-Benefits-of-Building-More-Housing-6-15-2021.pdf

https://www.statista.com/statistics/226144/us-existing-home-sales/#:~:text=U.S.%20existing%20home%20sales%202005%2D2023&text=In%202021%2C%20the%20U.S.%20home,from%205.6%20million%20in%202020

https://www.fhfa.gov/AboutUs/Reports/ReportDocuments/HPI_2021Q4.pdf