Will the Ann Arbor housing market crash in 2023?

University of Michigan Biomedical Research Building. The University of Michigan reported a record-breaking $1.7B in research volume for 2022. (Click On Detroit)

In a word – no. Barring existential threats – extreme weather events, expanded war, or political unrest, for example – the Ann Arbor housing market could look similar to 2019, but with less inventory, higher interest rates, and higher prices. The 2020 and 2021 and 2022 Ann Arbor housing markets were anomalies brought on because of the pandemic and historically low-interest rates.

We are headed back to more “normal” times with interest rates near the historical average of around 6 percent and 3 to 6 months of inventory of homes available for sale, a balanced market. A better market for buyers but still great for sellers who need to make a move, even if sellers have to give up some of the 25 percent market appreciation they have reaped since 2019.

1. Inventories are rising but still very low

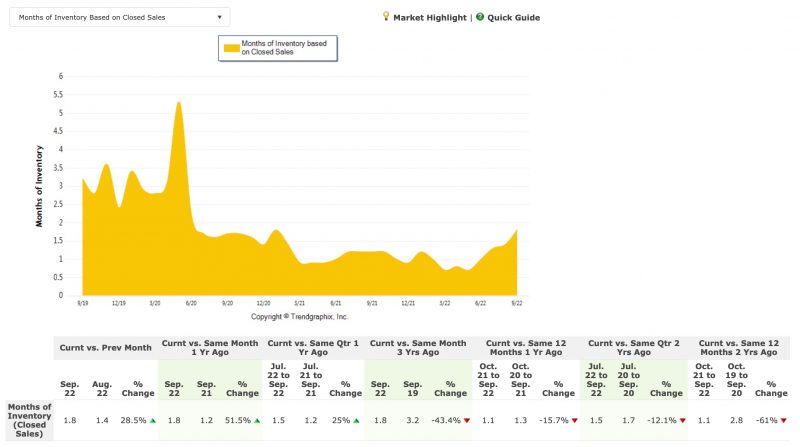

The current month’s supply of Inventory is up 51.5% over last year but still down 61% compared to 2019.

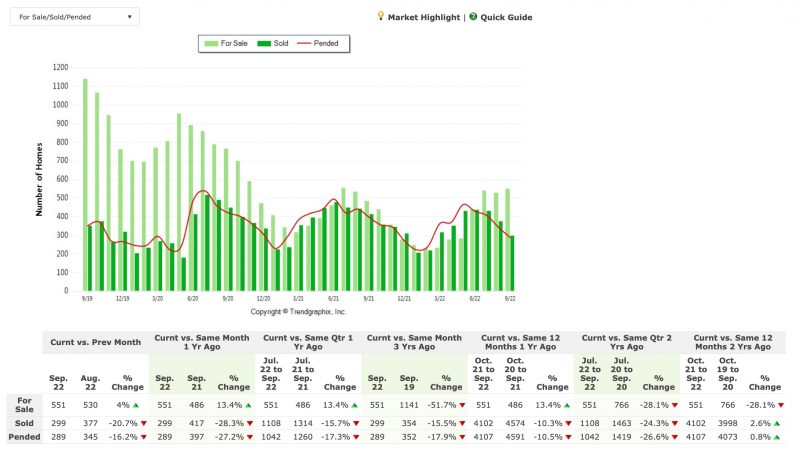

Homes available for sale YTD 2019 vs 2022 fell 28.1%, while homes sold increased 2.6%. (Entire Ann Arbor MLS)

We presently have a 1.8-month supply of homes (All Ann Arbor MLS areas). While this is up 51.5 percent from last year, this is still a strong seller’s market. (Three to 6 months supply is a balanced market, and above six months supply is a buyer’s market).

Average days on market are rising too, but it is still only 18 days compared to three years ago when it was 42, a 57% decrease. Homes in good condition and priced correctly can still be under contract in less than thirty days.

This ongoing lack of inventory explains why many buyers still have little choice but to act quickly and sometimes bid up prices. And it also indicates that the supply-and-demand equation won’t allow a price crash anytime soon. Buyers should expect more opportunities in top Ann Arbor neighborhoods, but there will be nowhere near a glut of homes available.

2. Not Enough New Construction

Toll Brothers New Construction at North Oaks in Northeast Ann Arbor

Builders have not kept up with demand for years. Homebuilders pulled way back after the last crash and never fully ramped up to pre-2007 levels. Now, there’s no way for them to buy land and win regulatory approvals quickly enough to quench the demand.

With rising interest rates, builders with any inventory will start offering incentives and maybe lower prices to keep sales moving. There is no chance we will have a repeat of the overbuilding of 15 years ago. Supply and demand can return to balance, but this won’t happen overnight. We will still be undersupplied in 2023.

3. Demographic trends are creating new buyers.

There’s strong demand for homes on many fronts. Millennials – those between ages 26 and 41, also called Generation Y — now represent America’s most significant population cohort. A 2022 report by the National Association of Realtors reveals that Gen Y represents the largest share of homebuyers in the country, at 43 percent. That includes the most significant percentage of first-time purchasers as well.

Downsizing baby boomers, those 62 and up, are another demographic bubble with pent-up demand. While it may be optimal to age in place, those with large homes with expensive maintenance, upkeep, and utility costs may need to sell due to health and financial reasons.

4. Ann Arbor is relatively recession-proof.

C.S. Mott Children’s Hospital in Ann Arbor, MI, is nationally ranked in 9 pediatric specialties. It is a children’s general facility and is a teaching hospital.

The University of Michigan, Area hospitals, and the tech industry here is going strong. U-M reported a record $1.7 billion in research spending in the fiscal year 2022, ClickOnDetroit reports. The National Institutes of Health was the most significant external sponsor, at $640 million. Still, the university also received millions from the National Science Foundation, the Defense Department, and the Department of Energy. For the past 11 years, U-M has been ranked the No. 1 public research university in the U.S. by the National Science Foundation. Add to that the 1.5 billion dollars of construction projects underway at the Univerisity of Michigan. Construction projects at the University seem to march on in good times and bad.

5. Ann Arbor offers an excellent quality of life.

Ann Arbor is a great place to live and attracts people from all over the country and the world. Particularly people who can work remotely are moving away from high-cost congested cities such as Los Angeles, Denver, Atlanta, Washington DC, and New York. Additionally, the University attracts professionals from around the world, often for 1 to 5-year assignments. This creates housing demand, and these incoming professionals often come from more expensive markets making Ann Arbor prices seem reasonable.

6. Lending standards remain strict

In 2007, no documentation loans allowed borrowers to get mortgages without documenting their income. Lenders offered mortgages to just about anyone, regardless of credit history or down payment size.

Today, lenders impose strict standards on borrowers — and those getting a mortgage overwhelmingly have excellent credit. The typical credit score for mortgage borrowers in the third and fourth quarters of 2021 stood at a record high of 786, the Federal Reserve Bank of New York says. “If lending standards loosen and we go back to the wild, wild west days of 2004-2006, then that is a whole different animal,” says McBride. “If we start to see prices being bid up by the artificial buying power of loose lending standards, that’s when we worry about a crash.”

7. Foreclosure activity is muted.

In the years after the housing crash, millions of foreclosures flooded the housing market, depressing prices. That’s not the case now. Most homeowners have a comfortable equity cushion in their homes. Lenders weren’t filing default notices during the height of the pandemic, pushing foreclosures to record lows in 2020.

Additionally, homeowners have more equity in their homes than ever. Since 2012, home prices have risen continuously, providing borrowers with large amounts of home equity. At the end of the first quarter of 2022, the average borrower had $280,000 in home equity — this is a gain of $64,000 over the past year and $125,000 over the past five years.

All of that adds to a consensus: Yes, home prices are pushing the bounds of affordability. But no, the Ann Arbor Housing Market won’t burst in 2023.

We can help you successfully buy or sell a home in Ann Arbor in any market. Reach out and let us help you understand the process and take the right steps toward a successful home sale or purchase experience.

Contact Us