2023 Ann Arbor Area Real Estate Market Forecast

The 2023 Ann Arbor area real estate market will likely be one where both buyers and sellers feel some pain. In 2023, buyers can afford less home than they could one year ago, while sellers see the market top in their rearview mirror and are forced to price lower than they hoped. However, there is a path for those who want to move in 2023. Read more to see where the housing market is now and what you should know if you plan to buy or sell an Ann Arbor area home in the coming year.

After being overwhelmed by the housing frenzy of the recent past, home sellers, buyers, and renters may be underwhelmed in 2023. The slowdown in home sales transactions that began as mortgage rates surged in 2022 is expected to continue, moderating home price growth and tipping the housing market balance away from sellers.

But with higher mortgage rates (6.5% vs. 3% one year ago), a moderation in home price growth will not be enough for the housing market to be a buyer’s bonanza. Instead, home shoppers will enjoy advantages such as a growing number of homes for sale. Still, costs will remain high, challenging affordability at a time when overall budgets continue to be squeezed by inflation.

If home shoppers and sellers have unrealistic expectations, they could find themselves in a stalemate in the year ahead. The 2023 housing market could become a “nobody’s-market” not friendly to buyers or sellers.

Home buyers and sellers ready for the challenge will need up-to-date information on market conditions and financing, creativity and flexibility to adjust, and a healthy dose of patience to create success. We are here to help with any questions you may have. (contact us)

2023 Ann Arbor Area Home Prices

Ann Arbor home price appreciation will be flat in 2023.

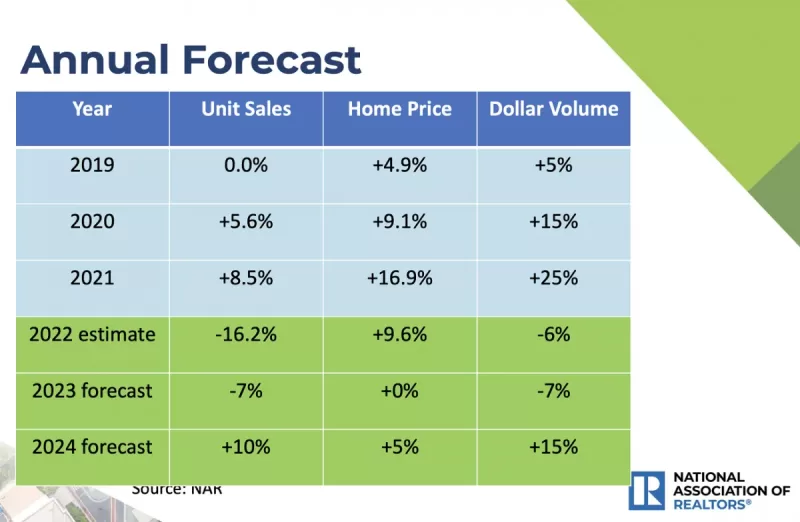

Real estate market predictions for 2023 from the National Association of Realtors.

After three years of nearly 10 percent annual home price gains, we are now in a correction phase. Prices will be below the peak prices of Spring and Summer 2022, when the norm was multiple offers on the first weekend of a listing, and sale prices averaged 104 percent of the list price.

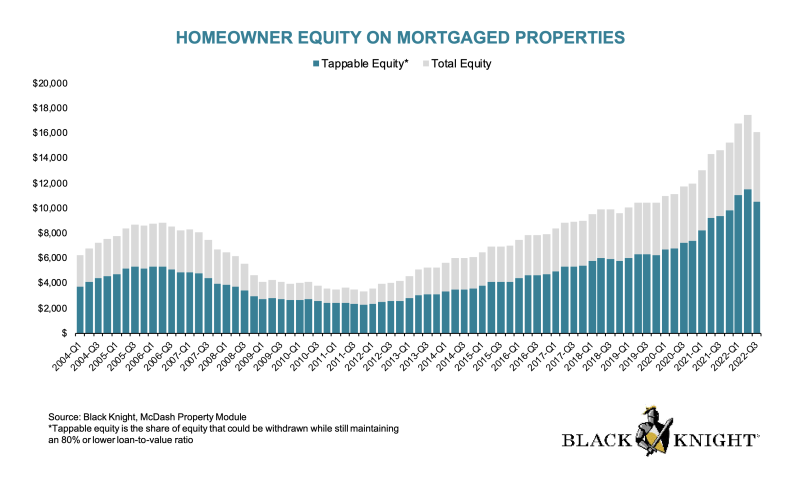

But don’t expect prices to tumble. If sellers can’t get their price, many will stay put. Homeowners have record home equity and coveted mortgages with 3 percent interest rates locked in for the long haul. In addition, real estate prices are “downwardly sticky,” meaning home prices rise quickly and fall slowly.

What to do:

When moving, buyers should always look for the best home that meets their needs within their budget. Timing the market rarely produces the best results.

If you are a buyer and have been out of the market for more than a few months, carefully review your budget and get an updated pre-approval letter from your lender. You will want to be sure you are considering homes you can comfortably afford.

Buying this winter may be your best strategy. With fewer listings expected, sellers listing now will be motivated. With fewer buyers in the market (than in the traditional spring market), you’ll likely have more time to consider an offer and be able to negotiate a better deal.

Sellers wanting to sell quickly will want to price “in front” of the market. This strategy will net you the most money in a falling market (we never know until after the fact). Having worked with sellers during the great recession, I know the most painful thing is to see a seller price too high and then chase the market down.

Sellers should not base their pricing on peak prices from 2022. Instead, sellers should price based on comparable homes closed after September 2022 and homes closed in 2021. Then carefully factor in the home’s location and condition.

Sellers should get their properties in the best possible condition before listing. Take care of deferred maintenance, update paint and flooring, maximize curb appeal, and consider staging the home.

You don’t need to wait until late spring to list, as the available inventory of good homes remains low.

Real estate price appreciation rates vary regionally, between nearby cities, and even neighborhoods in the same city, so don’t take your market guidance from national publications. Work with an experienced local agent early in the process to get the best up-to-the-minute pricing advice and negotiate successfully. This will net you the best price and terms for your home sale or purchase.

Mortgage Rates and Programs

Mortgage interest rates are expected to settle in the 5.5 % to 6.6% range.

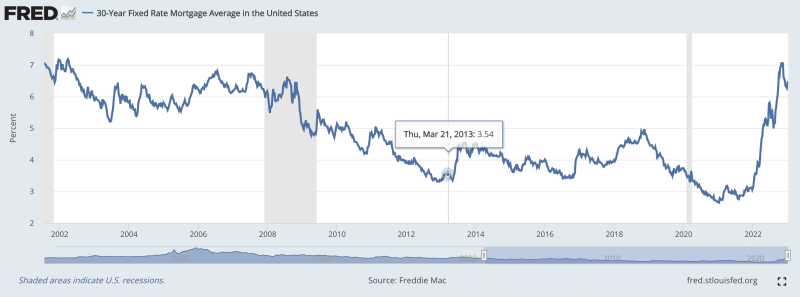

Interest rates. 6-7 percent is the historical norm. Source: FRED

30-year fixed-rate mortgages rose from their low of 2.67 percent in December 2020 to over 7 percent in October 2022. They are currently running at around 6.5 percent on January 1st, 2023.

All market participants are looking for ways to improve affordability (which boils down to the monthly payment). Lenders are working on thinner margins, variable rate loans with lower interest rates are more readily available with good terms, and sellers and builders are offering to buy down the mortgage rate. There will be more bargaining ability for buyers than we have seen in years.

“Mortgage rates are the lifeblood that drives home sales,” according to NAR Chief Economist Lawrence Yun. Yun said he believes mortgage rates may have already peaked. He points to an “abnormally high spread” between 30-year fixed-rate mortgages and the Treasury, which historically are more closely tied together. “As the mortgage market normalizes, it will be an opportunity for rates to decline even further,” Yun said, adding that he expects mortgage rates to settle at 5.7% by the end of next year.

Still, mortgage rates are more than double what they were a year ago, ramping up rapidly this fall and walloping housing affordability. But if inflation continues to slow and rates stabilize, that could bring more buyers back to the market and boost demand for housing, Yun said

According to Redfin, mortgage rates dipping from around 6.5% to 5.8% would save a homebuyer purchasing a $400,000 home about $150 on their monthly mortgage payment. To look at it another way, a homebuyer on a $2,500 monthly budget can afford a $383,750 home with a 6.5% rate; that same buyer could afford a $406,250 home with a 5.8% rate. Still, that’s much less affordable than a few years earlier. With a 3% rate common in 2020 and 2021, that same buyer could afford a $517,000 home.

What to do:

See our Mortgage PlayBook for innovative ideas on financing a home, or let us help you connect with a local lender.

The days of 3.00 percent fixed mortgages are gone. Rates will run in the historically normal range of 5-7 percent in the coming year. Variable rate loans such as a 5-1 ARM (adjustable rate mortgage) are worth evaluating based on your needs and could reduce your payment by several hundred dollars per month.

Buyers will want to spend more time early in the home-buying process to fully understand the expenses and fees involved with a home mortgage. Lenders are becoming increasingly creative and competitive to win your business. Get expense and fee estimates in writing and compare them before committing to a lender.

We strongly recommend choosing a local lender with local underwriting.

Be wary of lenders that quote low-interest rates but are slow to provide clear details about fees and expenses. Choose a lender that provides and fully discloses competitive rates and fees and is easy to communicate with.

Total Home Sales

Total home sales will fall 15 percent from 2022 levels

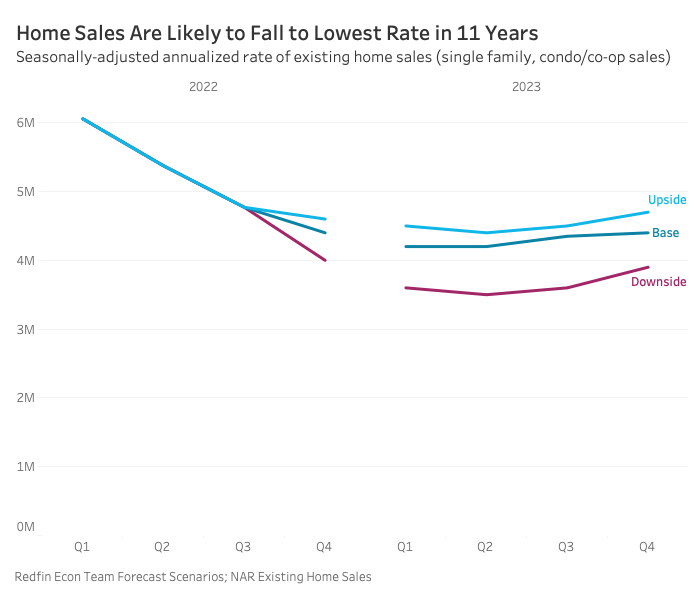

The total size of the market will decrease. Source: Redfin

NAR predicts 4.78 million existing-home sales in 2023, down 6.8% from 5.13 million in 2022 and 6.12 million units in 2021. Other forecasts predict total US home sales in 2023 will be even lower in the 4.1 to 4.5 million units range.

Redfin predicts about 4.3 million homes will be sold in 2023, according to Redfin’s 2023 Housing Market Predictions. “That’s fewer home sales than any year since 2011 when the U.S. was reeling from the subprime mortgage crisis,” the report states.

The reason? Many people can’t afford to buy, with mortgage rates hovering around 7%. And many homeowners holding lower rates don’t want to sell. The result, according to Redfin, will be a further decline in new listings in 2023.

What to do:

Sellers don’t need to wait until late spring to list, as the available inventory of good homes remains low.

Buyers should be ready when good homes hit the market as there are fewer of them.

Inventory and Days on Market

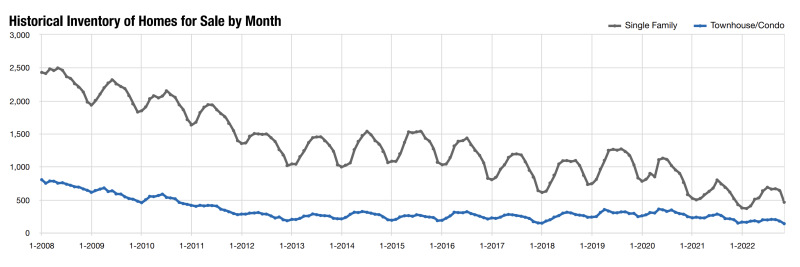

Available Ann Arbor area Homes For Sale will remain low but begin to increase.

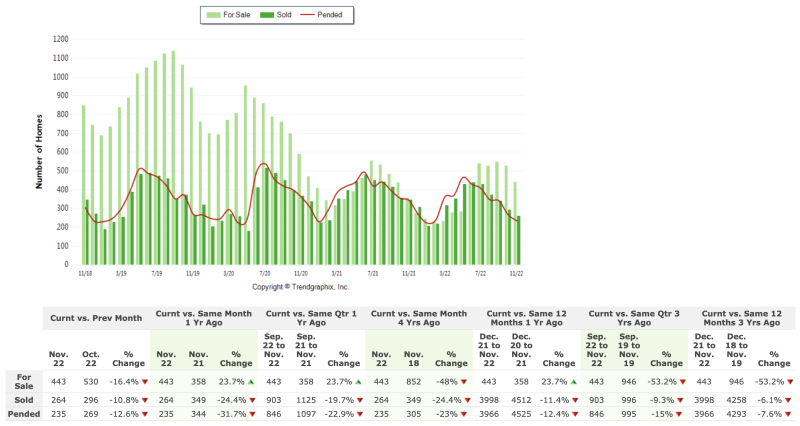

Homes for sale vs. Homes Sold – last four years. Ann Arbor MLS. Source Trendgraphics.com

Homes available for sale will increase but will still be well below historical levels. Inventory is up 40.5 percent in 2022 vs. 2021; however, as shown in the graph above, it is still way under pre-pandemic levels (the light green lines). There are 53 percent fewer homes on the market than in 2019: 443 vs. 946!

Months of inventory for sale are running at a 1.2-month supply, less than half of the roughly 3-month supply we were seeing pre-pandemic, and a balanced market is approximately 3-6 months of inventory.

The average number of days a home stays on the market before going under contract is presently averaging 19 vs. 37 in 2019.

In 2023 we will remain in a seller’s market with reduced total sales volume. Fewer buyers (with reduced purchasing power) will be in the market, and they will be chasing too few homes available for sale! Homes in good condition and priced right will continue to sell quickly. Buyers will have a little longer to decide and should be able to negotiate reasonable prices and concessions. We’ll continue to see multiple offers only on the best properties, which are priced competitively.

What to do:

Historical Home Inventory for sale by month. Source: Ann Arbor Area Board of Realtors housing stats. pg 12

Buyers – Be prepared so that you can act decisively when the right home hits the market. Know your numbers inside and out. Know your target neighborhoods and needs so you can confidently make an offer.

Sellers – In some markets, we may start seeing more homes available, which means more competition. Overpriced homes will sit. Buyers with reduced buying power and buyer sentiment of a “falling market” are hyper-sensitive about overpaying and buying into a negative equity situation. Higher-priced homes will see more competition and downward price pressure. Last year we had the “EBay effect” and fear of missing out; this year, we have the “recession” effect and fear of overpaying.

New Construction Starts Will Fall

Builder confidence has fallen over the last 11 months as mortgage rates rose and buyer traffic slowed dramatically. Fifty-nine percent of builders have reported using incentives, like mortgage rate buydowns and price cuts, to try to win buyers back, Nanayakkara-Skillington said.

The combination of higher mortgage rates, declining single-family homebuilding and inventory could worsen an existing housing shortage and the slow the pace of house price decreases.

“The limited available inventory fueled by both existing homeowners and homebuilders will keep the market tight, price declines minimal, and competition for desirable homes alive,” said Nicole Bachaud, an economist at Zillow in Seattle.

What to do:

You will have more bargaining power with builders. Look for prebuilt inventory with incentives such as mortgage rate buy-downs with rate locks, “free” upgrades, and reduced listing prices. Look for creative ways to bargain with builders who would rather throw in upgrades than show a lower sale price in the MLS.

No Foreclosure glut

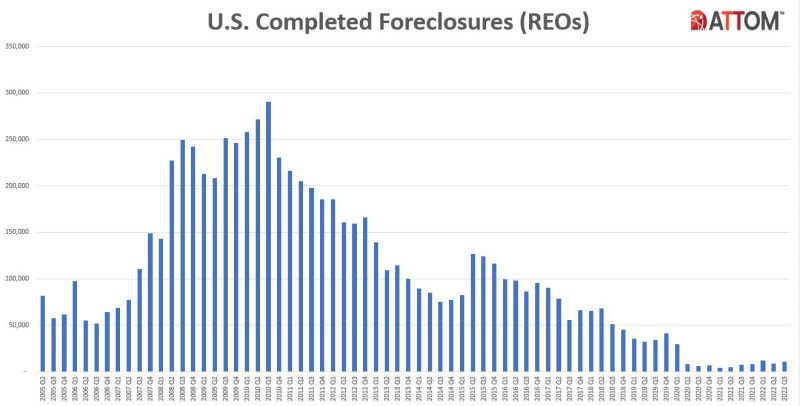

Source: Attom Data, foreclosure market report

In Michigan, foreclosures rose by 496.7%, from 991 in the first six months of 2021 to 5,913 in the first half of 2022. The foreclosure rate in the state of one in every 773 homes ranks as the 10th highest in the nation. The key is that while foreclosure rates are up, they are rising from a very low level and are still below pre-pandemic levels.

Lenders started foreclosure on 67,249 U.S. properties in Q3 2022, up 1 percent from the previous quarter and 167 percent from a year ago — nearly reaching pre-pandemic levels.

“Foreclosure starts, while rising since the end of the government’s foreclosure moratorium, still lag behind pre-pandemic levels,” said Rick Sharga, executive vice president of market intelligence for ATTOM. “Foreclosure activity reflects other aspects of the economy, as unemployment rates continue to be historically low, and mortgage delinquency rates are lower than before the COVID-19 outbreak.”

“Very few properties entering the foreclosure process have reverted to the lender at the end of the foreclosure,” Sharga noted. “In fact, nearly three times more homes were repossessed by lenders in the second quarter of 2019 than in the second quarter of 2022. We believe that this may indicate that borrowers are leveraging their equity and selling their homes rather than risking the loss of their equity in a foreclosure auction.”

Add to this, homeowners have record home equity, unlike during the great recession when home equity was at at record low. We do not expect foreclosure sales to be a significant part of the Ann Arbor area real estate market in 2023.

Homeowner equity is at an all-time high. Source: Black Night

What to do:

Buyers should evaluate a home purchase opportunity by determining their criteria for a home purchase, such as neighborhood and schools, lot and location within the neighborhood, neighborhood restrictions, home layout, and home condition. Ownership – whether bank-owned or privately owned should not be considered unless there is an opportunity to buy the property at a substantial discount to the market.

Home buyers perceive foreclosures as an opportunity to get a property below market value. The reality is that foreclosure properties tend to get bid up to market value – especially when there is a shortage of properties available for sale, such as we have now.

Additionally, foreclosure properties tend to suffer from a high level of deferred maintenance as financially strapped homeowners facing foreclosure tend to under-invest in home repairs and maintenance for the years preceding foreclosure. Inexperienced buyers will tend to underestimate the costs of these repairs and updates, especially in our current environment of soaring labor and material costs.

Thinking about a move in 2023?

Connect with an experienced local, trusted, and connected Ann Arbor real estate agent early in the process to set a plan for your move and to stay on track through the entire process. We are here to help regardless of your timeline for a move.