Find Your Starting Line: Calculate Your Net Worth

Your net worth number can tell you a lot. It is the number that shows you where you are on your financial path, and if you use it wisely, you can also use net worth as a compass to help you achieve larger financial goals. Homeownership is one of the greatest drivers of wealth-building – homeowners have 40 times the net worth of renters.

Your home as a Wealth Builder

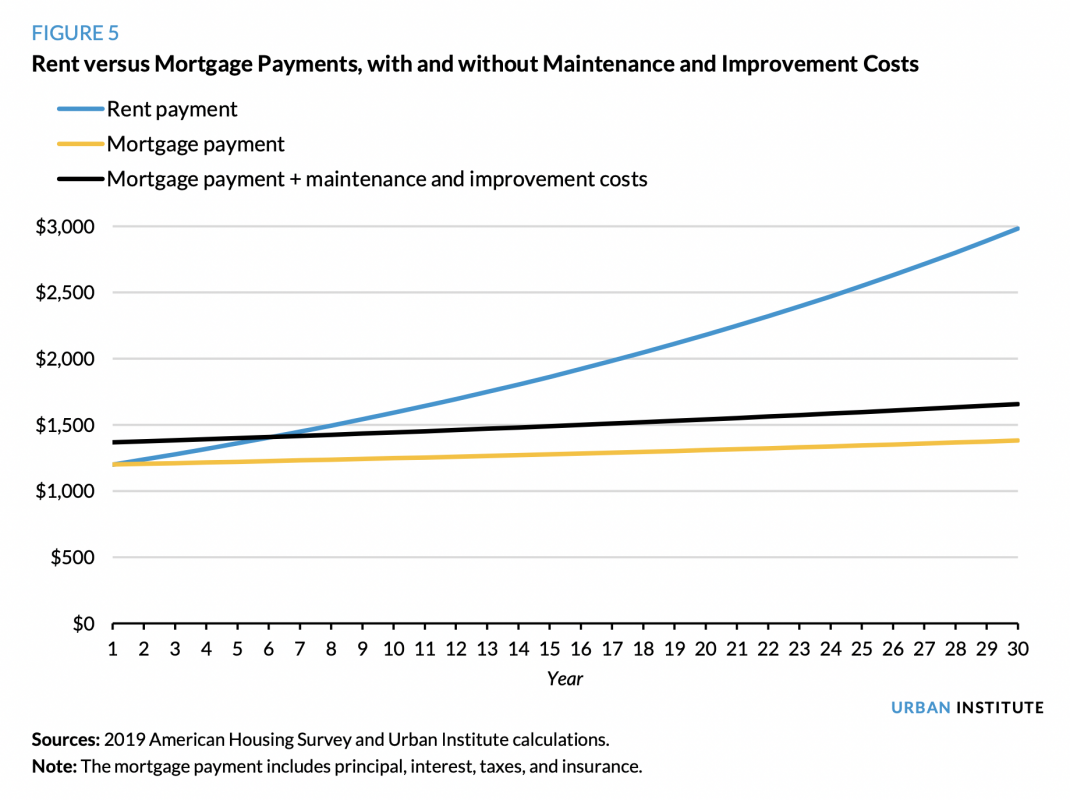

Your Home Payment is Fixed Over Time

In Michigan, your taxes will go up at about the rate of inflation with a max of 5 percent per year, but your mortgage payment will remain constant as long as you have a fixed loan. Renters are at the mercy of their landlords, who will raise rents whenever the market will allow it. The longer you hold your home, the cheaper your payments will be relative to renting.

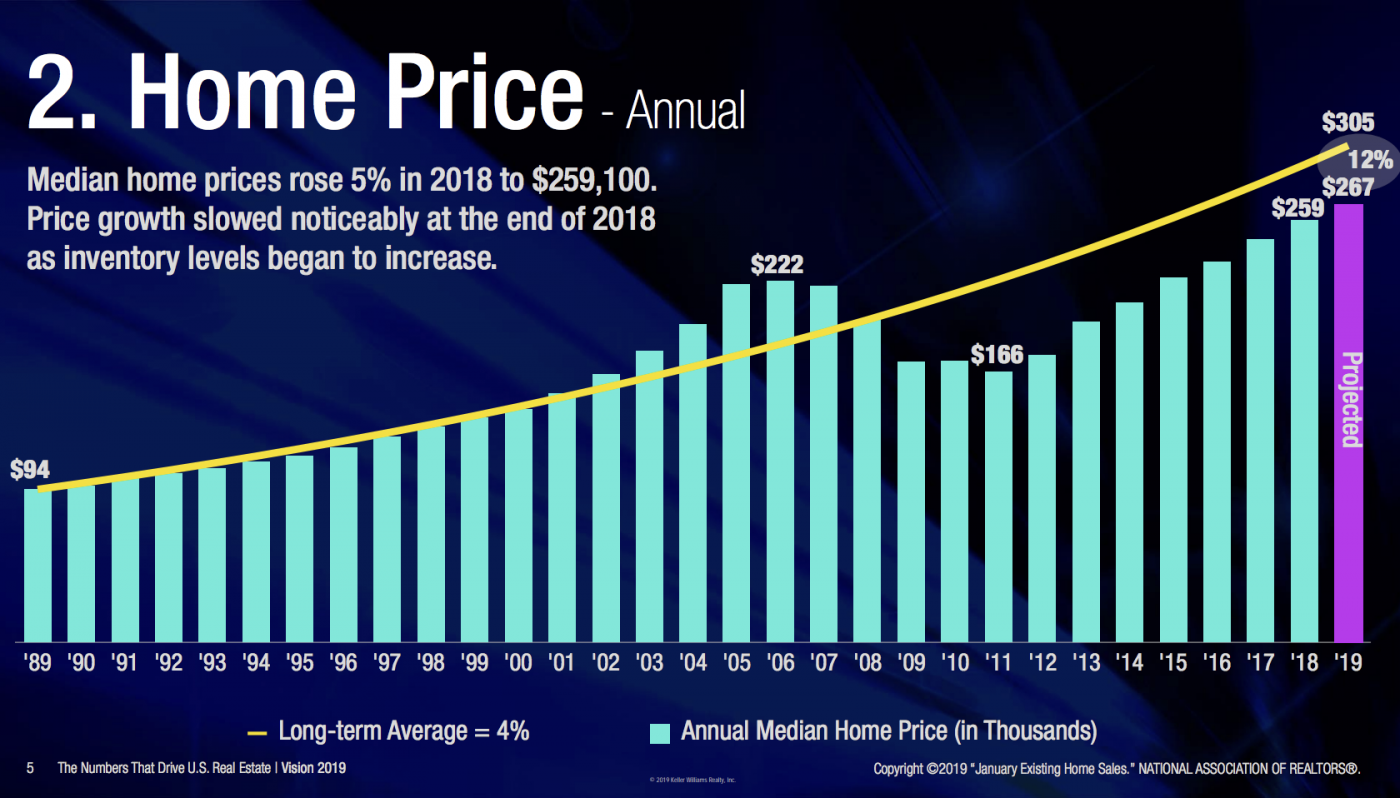

Home appreciation has averaged at 4 percent per year over the last 30 years.

Even assuming 0 appreciation, your home acts like a piggybank as the bank requires you to make a deposit towards equity each month. Over time you will have paid off the loan and have that equity, where as renting, your landlord will have it. If you bought a $300,000 home today with a 30 year fixed loan you would have $300,000 in 30 years just by making your regular payments.

But homes usually appreciate in value, an average of nearly 4 percent annually over the past 30 years, according to home price data from NAR. When accounting for home price appreciation, your equity can be significantly more than the value of the monthly principal payments. A homeowner who buys a $300,000 home today will have $994,180 in equity with 4 percent appreciation per year. This helps explain why homeowners have more than 40 times the wealth renters have.

How to Calculate Net Worth

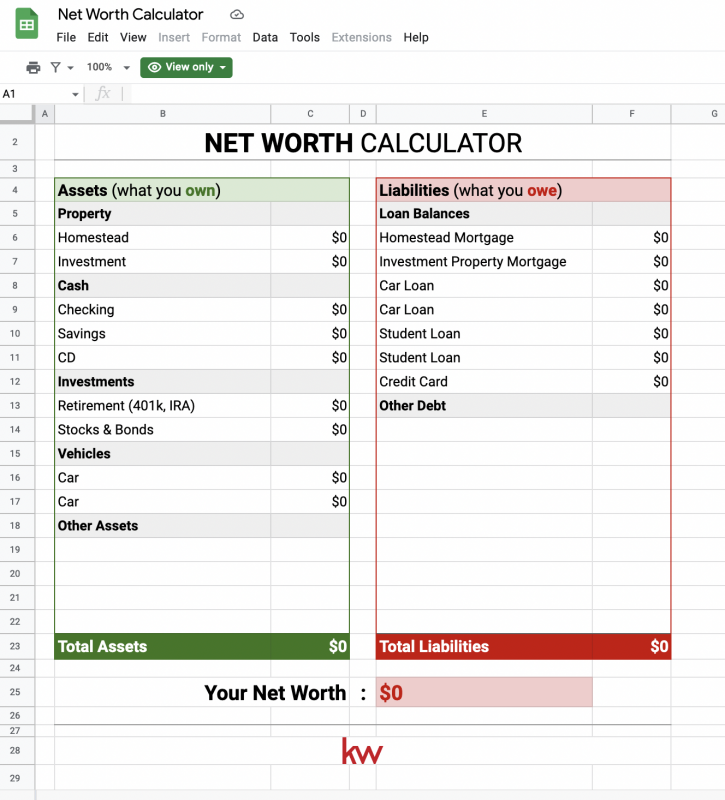

For aspiring homeowners looking to start their homeownership journey, understanding their net worth is the first step to understanding what their financial options are. And, for those further down their homeownership adventure, tracking their net worth can help them see how homeownership is affecting their financial well-being.

Figuring out where your net worth is requires some simple math. You can follow along below to determine your current number, or you can use this net worth calculator.

Begin Your Calculations

You’ll take a sheet of paper and list out all your assets, combining their value. Assets include things like automobiles, 401(k)s, savings accounts, and even nice jewelry.

Then, in another list, identify all your debts. These are anything that you owe on – student loans, car payments, and credit card balances, for example.

Then, subtract the total number of your debts from the cumulative number of your assets. Ta-da! That’s your net worth.

Next Steps

Your net worth number is just a number; it’s neutral. It’s neither good nor bad without context. Really, your net worth at any moment is just a way of understanding where you are.

However, your net worth number will help you to assess your financial future. As Gary Keller writes in SHIFT, “the first step in any decision is to get in the right mindset”. You can use your net worth number to help you set goals, track your investments, and ultimately measure how far you’ve come.

Don’t wait to buy real estate – buy real estate and wait.

Contact Us