Fannie Mae, the government-sponsored enterprise that backs most mortgages, stated recently that home buyer sentiment hit its lowest level since 2011. When asked to identify their top reason for this decline in sentiment, consumers cited the current rising interest rate environment along with the specter of continued rate increases.

Many buyers have been pushed to the sidelines because high-interest rates and rising prices have significantly eroded home affordability. However, if you are educated, effective tools and creative workarounds can help you buy and sell at the most favorable terms in today’s market.

Read our Mortgage Playbook, which explains several mortgage programs available today as well as hacks to help those with current mortgages pay less over time.

Not all lenders offer the same programs, though. Reach out to Piperpartners if you wish to discover which programs may be right for you, and we’ll put you in touch with the right lenders.

7 Mortgage Hacks to Lower Your Payments and Save Money

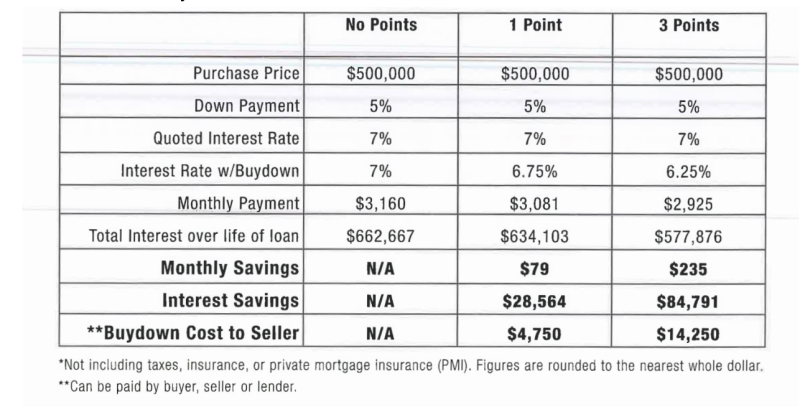

Interest Rate Buydowns

A common misconception is that 1%=1 point. In Reality, approximately 1 point=.25% of the mortgage rate. Buying down the rate by 1 point costs 1% of the loan amount.

An interest rate buydown is a one-time payment that reduces the interest rate for the length of the loan. If you buy down the rate by 1 point, this will cost 1% of the loan amount. This typically reduces the rate by about .25%. So, on a 475,000 loan, one point will cost you $4750 – but by decreasing the interest rate, you are saving $28,564 over the life of the loan. You save tens of thousands over time by paying a few thousand dollars upfront.

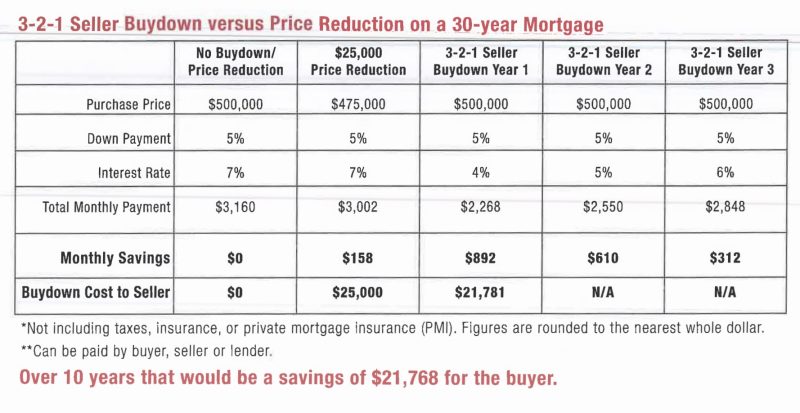

In this graph, you will notice how a buydown vs. a price reduction benefits both the buyer and the seller.

In this market, where sellers are receiving fewer multiple offers and homes are staying on the market longer, consider negotiating with the seller to buy down your interest rate.

Adjustable Rate Mortgages

An adjustable rate mortgage (ARM) is a loan with a fixed (lower) interest for the first period of years which then adjusts, usually yearly, for the remainder of the life of the loan.

With a 5/1 ARM, you will have a fixed rate for the first five years. Typically this rate is lower than the rate of a 30-year fixed-rate mortgage. After five years, the loan becomes adjustable, with rate changes yearly after that. By choosing this finance route, monthly interest payments will likely decrease more than if you bargained for a less expensive purchase price. A 5/1 ARM is most common, but you could also opt for a 7/1 ARM, where the rate is fixed for the first seven years, then adjusts each year, or a 7/6 ARM, where the rate is fixed for the first seven years, then adjusts every six months.

Buyers often fear that the adjustments will hike up their rates without warning. While ARMs can make budgeting difficult, there are restrictions to the amount the interest rate can change each period. This is called an interest rate cap and will vary from loan to loan. If you take this route, be sure the interest rate cap is one you can afford.

This can also be a great option if you plan to be in your home for three to seven years.

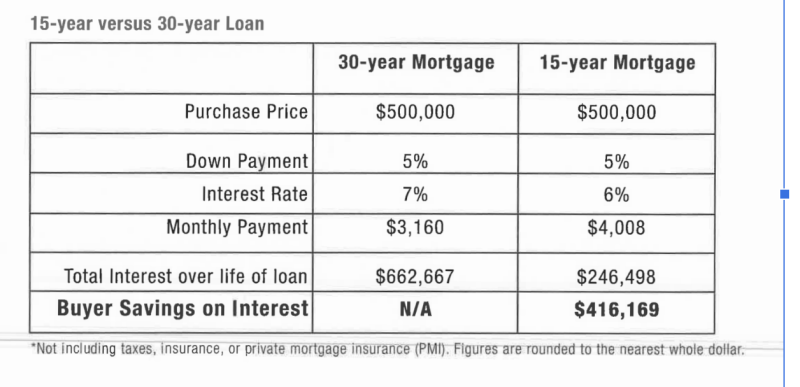

15 Year Mortgages

The savings on a 15-year mortgage can be startling. If you compare two loans on the same amount amortized at 15 and 30 years, the day you pay off the 15-year note, you’d still owe over 72% on the principal on the 30-tear note. 15-year notes accelerate equity build-up.

If a 15-year mortgage is plausible in your monthly budget, it offers significant long-term savings. First, 15-year mortgages typically have a lower rate. Second, reaching 20% equity in your home will happen more quickly with higher payments so that you can avoid private mortgage insurance more quickly. Although monthly payments will be higher, you will start building equity in your home much sooner. You’ll save hundreds of thousands over the life of the loan with less interest paid.

Bridge Loans

Bridge loans allow you to get the money out of your house and put it towards your new purchase before selling your home. It is not a commonly offered loan, but it is becoming increasingly used as lenders search for more clients. This loan is short-term, only lasting up to six months, but if your house is ready to sell and your lender offers this as an option, consider it!

Rate Locks

Plenty of lenders offer the option to get pre-approved for a loan and lock in their rate for a predetermined number of days. That way, you know exactly what you can afford when shopping for homes. If you know you will buy soon but are worried interest rates will continue rising, this is a good option.

Rate locks are typically available for fixed-rate conventional loans for primary and secondary homes, but be sure to ask your lender how long the rate is locked for.

This is especially important for new construction deals, which may take up to a year or more to complete. You will need a rate lock long enough to cover your expected construction period and some cushion for delays.

Seller Financing

If the seller has either paid off their entire mortgage or can do so once they have the buyer’s down payment, seller financing is an option. Rather than using a traditional lender, buyers purchase a home through the seller. Enjoy more flexible mortgage terms and lower closing costs. This can be in the form of a Land Contract – where the buyers borrow money from the land owner until they’ve paid off the purchase price, or a Lease to Own – where renters pay until they’ve reached an agreed upon purchase price at which point they have the exclusive option to purchase the property, or an Assumable Mortgage – where the buyers assume responsibility and subsequently take over the seller’s current mortgage.

Homebuyer Assistance Programs

There are plenty of homebuyer assistance programs that exist to help you. Some common types of programs are:

- Down Payment Assistance Programs, where grants may be applied to the down payments or closing costs.

- Affordable First Mortgage Programs, where the interest rate is subsidized for certain buyers

- Mortgage Credit Certificates, where tax credits allow first-time homebuyers to pay off some of their mortgage interest each year.

These programs require certain conditions for home buyers to qualify, such as limits to household income, type of property, and the home’s location. Reach out to your lender or us and see what assistance programs you may qualify for!

When obtaining a loan, borrowers often only consider monthly payments. But, when you shift your mindset to view the entire life of the loan, seemingly minor changes can mean significant savings. Utilize resources – local real estate agents, lenders, and online payment calculators – to become a master of the mortgage market. Take advantage of innovative loan opportunities as the market shifts!

If you are considering purchasing in the next year, or are interested in learning more about any of these financing options, reach out for a no-obligation consultation: