Buying your first home can be one of the most exhilarating moments of your life when done right. Follow our 5-step plan and get into the perfect home with a minimum of stress and uncertainty while avoiding costly missteps. When you are armed with the right information and preparation, you will find the process progresses in an orderly, organized fashion from financing to shopping to closing. You will feel comfortable acting decisively with the right bid to win the home.

Over our many years of helping home buyers find the perfect home for their family, we have found these five steps will lay the best foundation for success:

Prepare Your Finances Before You Start Shopping

Plan your home buying timeline at least a year in advance. Don’t rush the process. Buying a home is a complex and emotional process involving big decisions on many different levels.

You want to lock down the financial variables as much as possible before you dive into your home search. Track your spending – know where your money is coming from and where it is going and how predictable your income is. Establish a solid pattern over months or years so that you are confident about your financial ability to take on a mortgage and the related expenses of home ownership.

Organize your financial documents. Your lender will provide a list of what you will need to apply for a mortgage. Your lender will ask for these first, so now is the time to get them in order. If you are self-employed the requirements are more complicated and your lender will provide you guidance.

Save, Save, Save

Live below your means and put the difference in savings. Leading up to purchasing your new home, build a war chest for your down payment, closing costs, moving expenses and new home repairs and updates. Moving is expensive. Don’t underestimate the cost of preparing your new home and setting it up the way you want. Things like paint, flooring, shelving, furnishings, landscaping tools and supplies for maintenance all add up. The more you save in the beginning the better your experience will be as you settle into your new place.

Be Systematic

Undertake a systematic home search with an experienced agent

An experienced agent will be a good listener and will understand your family’s needs. They will know all of the neighborhoods you are interested in. They will have sold many homes over more than one real estate cycle. You want someone that has seen buyer and seller markets. A great agent will have sound systems and processes, which they can readily communicate, to get you into the best home in your price range and in your time frame.

A great agent will know how to position and negotiate offers. They can work to find homes that are not even on the market and identify homes and neighborhoods that fit your needs that you may not have thought about. They will help you make great decisions and, more importantly, help you avoid bad decisions.

They will be with you from start to finish – not trade you off to another department during the transaction. They will have access to tradespeople, lenders, inspectors and be a resource for you after the sale.

A great agent will keep you on track. It’s easy for a buyer without a clear strategy to go helter-skelter from one open house or neighborhood to the next and ultimately make an impulsive purchase. An agent should be your partner who helps keep you focused and grounded. He or she will point out the characteristics of a property that are aligned with your needs which will likely cause the best long term appreciation. For example, it’s easy to focus on paint and furniture, the so-called ‘Pottery Barn effect’, and in the excitement forget important things like the floor plan and if it fulfills your family’s needs for functionality and lifestyle.

Don’t Overspend

Being house-poor is not a good feeling. It is better to live with fewer amenities than to have the home of your dreams but not be able to enjoy it because you are stressed over the expenses. Your home should be a savings and retirement vehicle for you and also the place where you live your perfect life and where your dreams become reality.

Having to struggle to make house payments or to pay the operating expenses for a home can cause a lot of unnecessary stress. Avoid this by factoring in costs for home maintenance. A good rule of thumb is to budget 1 percent of the sale price per year for repairs and upkeep, property taxes, and furniture. Also, consider what if one of the partners loses a job or becomes disabled, will you be able to stay in your home?

Decide how much housing you want to consume. Money not spent on housing can be saved for college education, travel, entertainment or retirement. Work through these trade-offs and get clear on your goals. This will help you stay on track and shopping in your price range.

Act Decisively

In real estate, those who wait lose! Be decisive. Once you have clarity about your needs, your finances and that you are working with trusted advisors to systematically find you the right opportunities, you will be ready to make a decision and move quickly on the right property. You will often need to act fast; as with all good properties, other buyers will spot the good opportunity. By preparing in advance you are in a position to act before the crowd shows up.

You will know it when you see it! I know this is a cliche, but it’s true. Trust your gut. Remember, decisions are made based on emotions and are justified and supported by logical research.

Missing Out

Sometimes you may bid on a property only to get outbid by someone else. Even your aggressive, well-positioned offer may not win. It’s stressful and disappointing to get your hopes up and then think the perfect property got away.

My experience tells me that there is always a better home out there for you. I have experienced this personally and in helping countless buyers along the way. Many years ago I relocated to St. Louis for a job. We bid on five homes that all fell through for various reasons. That 6th one was the best. I am always confident that if we miss out on a home something better is waiting around the corner.

Over-Bidding.

In a hot seller’s market, like we have been in for several years, people fear that they are over-bidding. So how do we figure what is the right price? The right price is where if you bid this amount and you win, you won’t feel terrible about it and you can afford it. If you lose the bid, you won’t say “I could have/should have gone with a higher bid”. It’s a riddle.

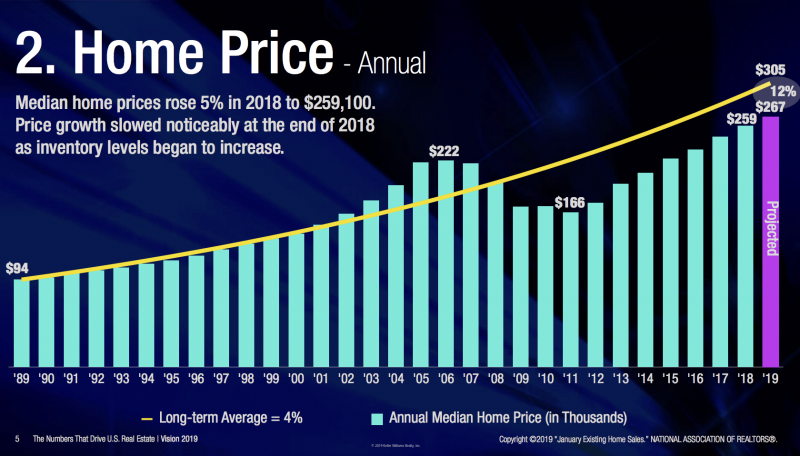

Consider that over the long haul real estate has appreciated steadily at 4 percent per year nationally. Once you are in a home your expenses are locked down. No one is going to raise the rent. Taxes can only rise incrementally over time. You will pay more towards the principal on your mortgage as you work through your amortization schedule.

The annual median home price appreciation over the last 30 years has been 4% per year

You will find that, years later, as your closing date has faded into the past, your home purchase was one of the best financial and lifestyle decisions you ever made.

If you get the right team backing you and follow these steps you will find the results satisfying and avoid unnecessary financial and emotional stress.

Reach out to us today for a no obligation home-buying consultation. We will lay out a plan for you that best suits your needs whether you are ready to buy today or years from now.