What to do with this Information

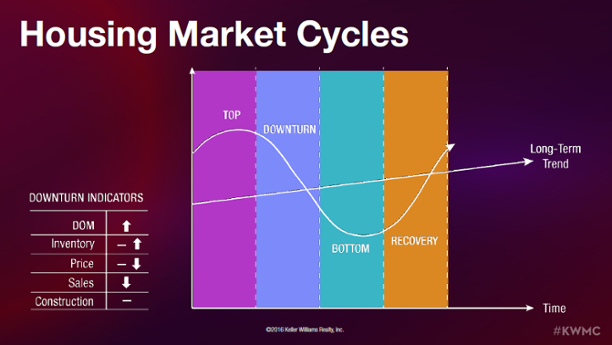

With the market at its healthiest in nearly a decade, now is the time to talk with an experienced real estate agent about what could be the best next step for you. Remember, shifts are going to happen, but you can minimize your vulnerability by taking actions now that will help you thrive, not merely survive, when the next one occurs.