What Is The Role of Real Estate In Economic Recovery?

As the financial landscape of the country shifts, real estate may play an important role in economic recovery.

Why Real Estate?

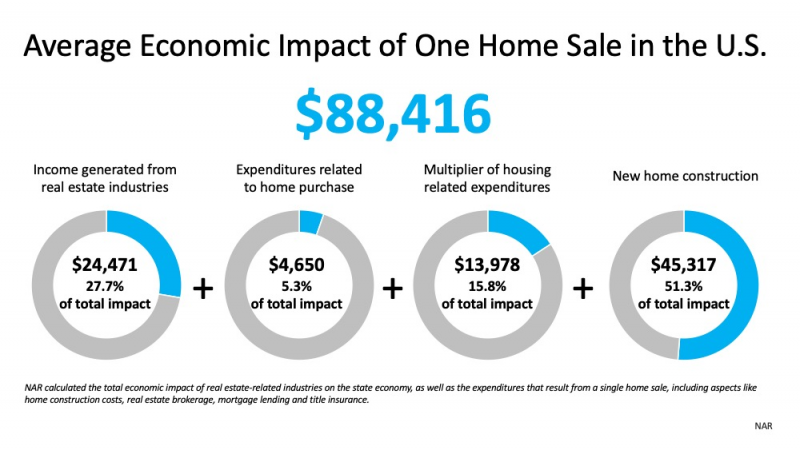

First, housing plays a large role in the local economy.

Importantly, this impact is strong when a new home is built and sold. According to a study by the National Association of Realtors (NAR), the average new home sale has a total economic impact of $88,416. As outlined above, this impact is from real estate industries, expenditures, and new homes.

Robert Dietz, Chief Economist and Senior Vice President for Economics and Housing Policy of the National Association of Home Builders (NAHB) says: “Overall, the data lend evidence to the NAHB forecast that housing will be a leading sector in an eventual economic recovery.”

When Will The Economy Pick Back Up?

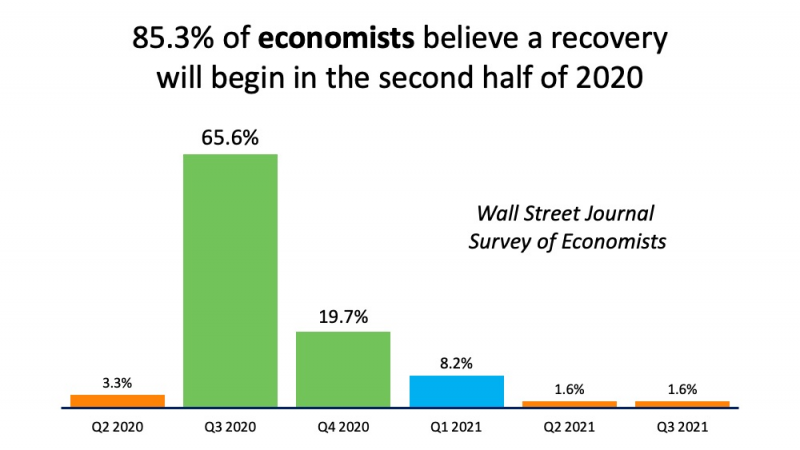

The Wall Street Journal Economic Forecasting Survey, which polls more than 60 economists on a monthly basis, 85.3% believe a recovery will begin in the second half of 2020:

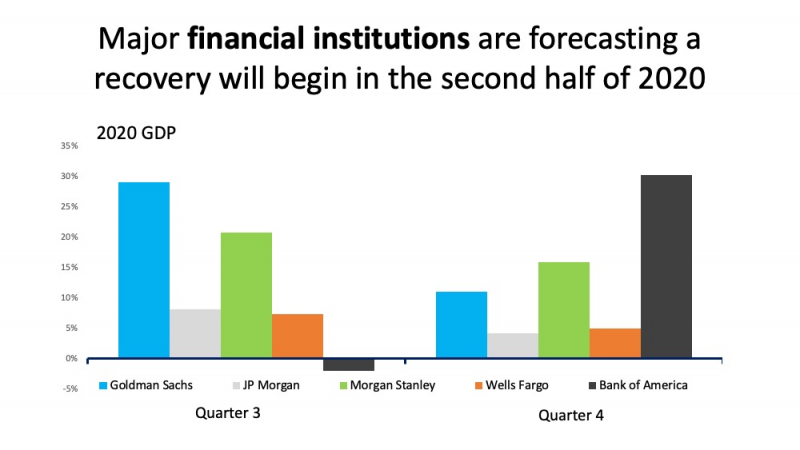

In addition, five of the major financial institutions are forecasting positive GDP in the second half of the year. Moreover, four of five expect a recovery to begin in the third quarter of 2020, and all five agree a recovery should start by quarter four:

For more information on current real estate market conditions or how to navigate buying or selling a home under COVID-19 safety protocol, contact us!